Star Protect Insurance for your Mercedes-Benz Car

An understanding of security that goes further than just the car, Star Protect Insurance for your Mercedes-Benz gives the protection it deserves. With great partners and comprehensive benefits, you can be assured that your car is secured and you have complete peace of mind, no matter where you are driving.

Why Star Protect Insurance for your Mercedes-Benz Car?

- New Star Protect packages: Star Protect Gold Plus and Star Protect Platinum Plus are available with the addition of EMI covers.

- Insurance program in collaboration with Reliance General Insurance, TATA AIG General Insurance, and ICICI Lombard General Insurance.

- Customised Star Insurance Package available till the 10th year of the age of the car

- New top-up covers- Key cover, EMI cover, Consumables and Conveyance Benefit

- Cashless claims settlement at authorized workshops

- Assurance of repairs using genuine spare parts

- 24 x 7 access to Mercedes-Benz Financial Call Centre

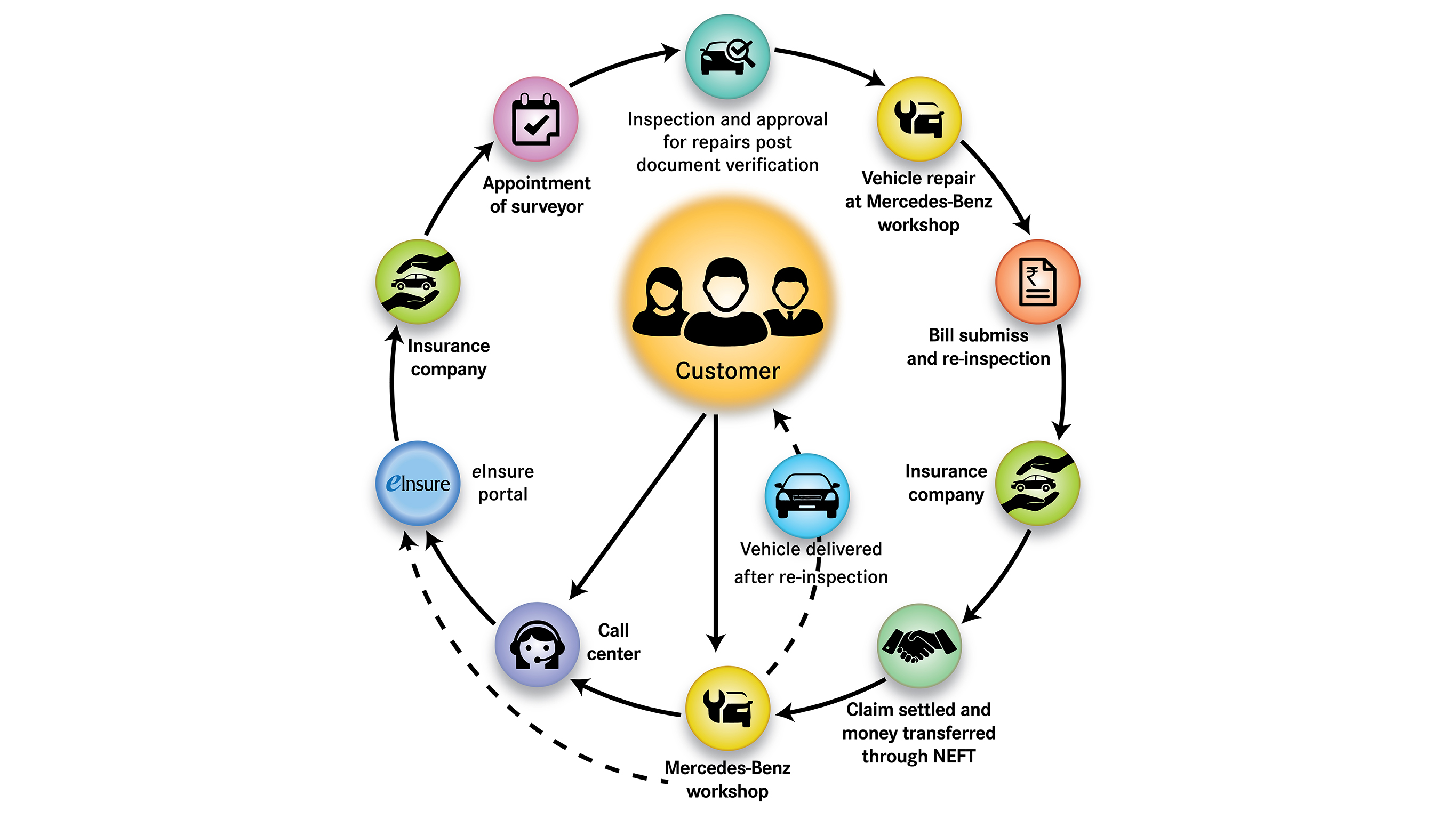

Claim Process

Claims Turn Around Time

- Online Surveyor deputed within 30 minutes of claim registration.

- Surveyor establishes contact with the customer/dealer within 2 hours of claim registration for vehicle inspection.

- Online assessment is done within 4 hours of claim registration.

- Work order approval with confirmed liability is given in 2 days after the day of inspection.

- Vehicle release order issued within 2 days after repair and receipt of the invoice from the dealer.

- The agreed claim amount is paid to the dealer within 3 working days.

Contact Details for Claim Intimation: - Claim intimation & registration, call us at 1800 212 3374 or 0008000501888 (Toll-Free exclusive for MBFSI/Mercedes-Benz)

- Send an e-mail to mbfsindia@mercedes-benz.com

- Please obtain the claim registration number (It is useful for future reference)

;Resize=(600,450))

Star Protect Covers

1) What is Depreciation Shield

Covers the depreciation amount on assessed damaged parts allowed for replacement during repairs in the event of a Partial Loss to the Insured Vehicle.

2)What is Vehicle Replacement Advantage (Return to Invoice)

Replace the insured car with a new equivalent or near equivalent car of similar make, and model, including a Comprehensive Cover Policy, cost of registration including Road Tax and Octroi, payable for the new car.

3)What is Engine Protector

Covers the consequential damage to the engine's internal parts and/or damage to the gearbox arising out of water ingression/leakage of lubricating oil, due to Accidental means.

4) What is TYRE & RIM Safeguard

In case of damage to Tyre(s) and Rim(s) of the car arising out of bulge/puncture/burst/cut, the cost of replacement of Tyre(s) and Rim(s), (Up to 4 Tyres & 4 Rims during a policy period) is covered.

5) What is EMI Cover

This cover pays the EMI (not exceeding one) falling due after the accident of the vehicle in respect of the Loan availed, provided the vehicle is lying in the workshop for repairs following an accident exceeding thirty (30) days due to:

a. Non-availability of parts at the repairer or

b. The workshop is closed due to strike/lock-out or

c. Extensive damage to the vehicle resulting in man-hour requirement exceeding 30 days and certified by the independent surveyor appointed by the Company.

6) Loss of Key

In case of irrecoverable loss of keys of the Insured Vehicle, the cost of a new lock set and installation cost would be covered. The benefit is once in a policy period. The sum insured for this cover is Rs.30,000.

7) What are Consumables

Coverage for the cost of consumables required to be replaced/replenished during the repair of the damaged vehicle. It includes engine oil, gearbox oil, power steering oil, coolant, AC gas oil, brake oil, AC refrigerant, battery electrolyte, windshield washer fluid, radiator coolant, nut & bolt, screw, oil filter, fuel filter, bearings, washers, clip, wheel balancing weights, and items of similar nature excluding fuel.

8) What is Conveyance Benefit

A per day cash benefit for 7 days, if the vehicle is rendered unusable due to repairs required to be undertaken in a workshop consequent to an Accidental loss. The benefit will start after the survey is done.

;Resize=(600,450))